Where are mortgage rates headed in 2019?

Where are mortgage rates heading in 2019? The most likely correct answer is up. But how high? Nobody know, but let’s look at what the experts think.

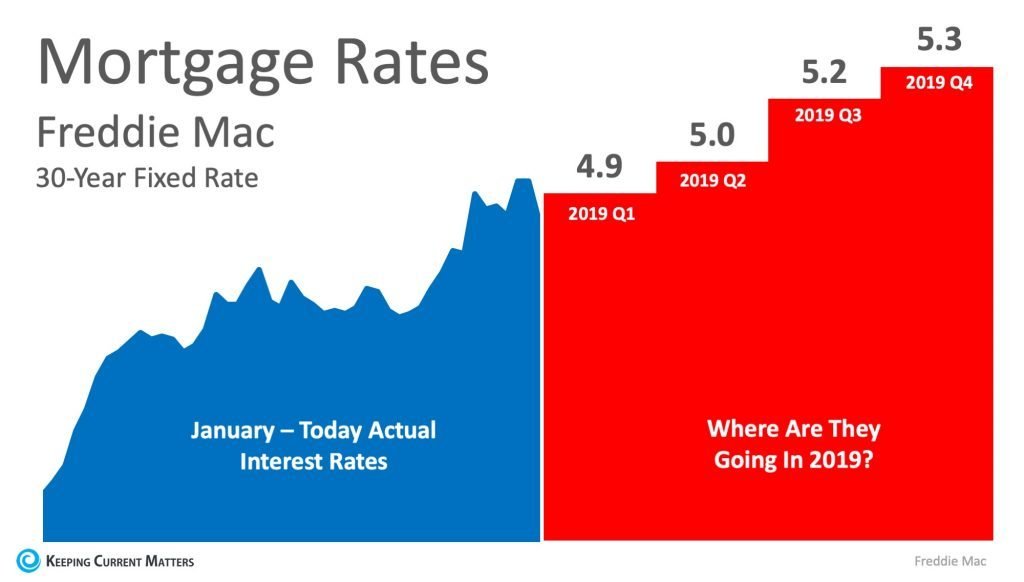

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate, the greater the payment will be. That is why it is important to know where rates are headed when deciding to start your home search. The chart above was created using Freddie Mac’s U.S. Economic & Housing Marketing Outlook. As you can see, interest rates are projected to increase steadily throughout 2019.

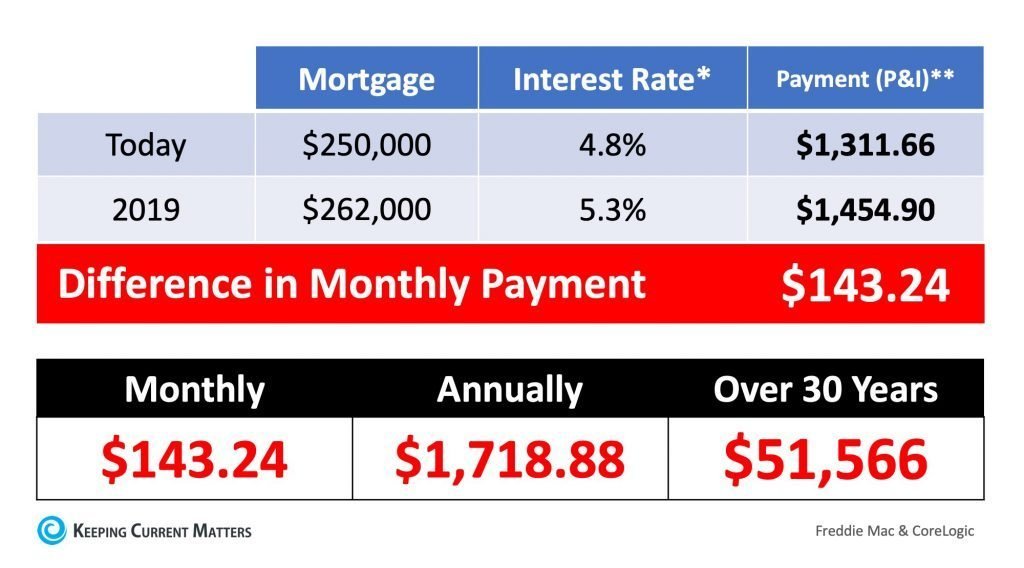

If home prices appreciate by 4.8% over the next twelve months as predicted by CoreLogic, then here is an example of the impact that an increase in interest rate would have on the mortgage payment of a home selling for approximately $250,000 today:

What do other experts predict?

National Association of Realtors (NAR): Expect rates around 5.3%

Paul Bishop, the NAR’s vice president of research, believes rates will head north next year.

“We’re anticipating that the economy will continue to grow throughout 2019. Also, we expect that the Fed will continue to raise interest rates,” says Bishop. “While the Fed doesn’t control mortgage rates, it’s a signal to the rest of the markets that the Federal Reserve thinks the economy is strong. The financial markets will take their cue from that. So we anticipate that rates will trend up through 2019 and into 2020.”

Bishop says the NAR predicts 30-year fixed interest mortgage rates to average around 5.3 percent in 2019.

“The potential buyer who’s thinking if now is the right time to buy needs to do the math and determine what the impact of potential rising rates would be on their payment,” he adds.

Case in point: Say you have a $200,000 mortgage. A half-point jump—going from 5 to 5.5 percent—equates to an increase of about $62 a month.

“It’s wise for the buyer to focus on what it will cost them if rates rise, and not just focus on the rate itself,” Bishop notes.

Given that we’re seeing a continued rise in mortgage rates and that it’s very unlikely rates will decline over the next year, “buyers should consider locking in a rate sooner rather than later,“ says Bishop.

National Association of Home Builders (NAHB): Rates should stay above 5 percent

Robert Dietz, chief economist for the NAHB, is forecasting rates to average 5.2 percent in 2019, but they may rise above 5.3 percent by 2020.

“We expect, at a minimum, the Fed to raise the Federal Funds Rate by 75 basis points through mid-2019,” notes Dietz. “Most forecasters expect additional rate hikes beyond this. But our analysis indicates that the economy will be noticeably slowing by late 2019.”

Dietz notes that mortgage rates track the 10-year Treasury rate. These are set to increase as the labor market tightens and the Fed seeks to keep inflation contained.

“Rates have increased by approximately 100 basis points over the last year. Hence, now is a good time for buyers to evaluate how large a mortgage they can afford given their household income. Buyers should also anticipate that a slowing economy could mean lower job and wage growth over the next three years,” he says.

Mortgage Bankers Association (MBA): Rates north of 5 percent are coming

The MBA foresees 2019 mortgage rates averaging 5.1 percent.

MBA’s chief economist Mike Fratantoni and associate vice president of economic and industry forecasting Joel Kan recently said in a recent forecast commentary: “While the Federal Reserve is expected to increase short‐term rates further, 30‐year mortgage rates should rise only modestly from here, averaging 5.1 percent for 2019 through 2021. We expect that the Fed will raise rates three times in 2019 and hold the fed funds rate at just over 3 percent.”

They further expected housing demand to remain at a healthy level; this will lead to a boost in purchase originations. They attributed this to a continued low unemployment rate, which they expect to decrease to 3.5 percent by late 2019.

“Economic growth is expected to continue its strong showing into 2019…We forecast 2.3 percent growth in 2019. This growth will help support the job market and wage growth, which is an important factor for housing,” they said.

Fannie Mae: Expect a modest increase—4.8 percent

Fannie Mae has slightly better news for borrowers. In its October 2019 Housing Forecast, the group predicted 30-year fixed-rate mortgage rates to average 4.8 percent.

“Economic conditions remain supportive of additional rate hikes in 2018 and 2019, as the labor market has tightened and inflation continues to hover just above the Fed’s 2-percent target,” stated Fannie Mae Chief Economist Doug Duncan in that forecast.

Duncan added: “Our expectations for housing have become more pessimistic: Rising interest rates and declining housing sentiment from both consumers and lenders led us to lower our home sales forecast over the duration of 2018 and through 2019. Meanwhile, affordability, especially for first-time homebuyers, remains atop the list of challenges facing the housing market.”

Kiplinger: Brace yourself for a 5.3 percent rate

Another esteemed industry expert on rates is Kiplinger. In its most recent economic forecast, the publisher cautioned that rates will likely increase next year. Kiplinger staff economist David Payne wrote that the 30-year fixed-rate mortgage will probably rise to 5.3 percent in 2019.

“Long-term interest rates have dropped a bit as some equity investors retreat to the bond market, which usually happens during stock market corrections. However, once the correction is over, long rates should head up again,” wrote Payne. “The Federal Reserve’s rate hike program will put upward pressure on long rates well into next year.”

———————————————————

Depending on the amount of the loan that you secure, a half of a percent (.5%) increase in interest rate can increase your monthly mortgage payment significantly. But don’t let the prediction that rates will increase stop you from purchasing your dream home this year!

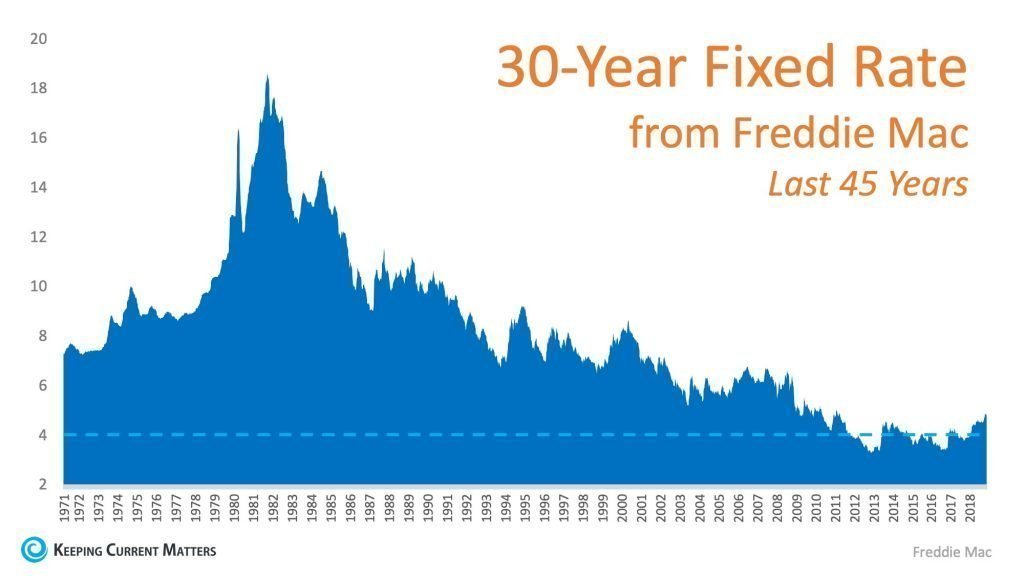

This is a look at a historical view of interest rates over the last 45 years.

Rates are still historically low. But loans for homes will likely rise in 2019. Now may be the best time to reach out to your local lender to see how much house you can afford while conventional loan rates are still below 5%. The make sure you are pre-approved for a loan before looking at homes with me!

Thanks to Erik J. Martin The Mortgage Reports Contributor, for his contribution to this article. Edited by Matt Morano, Realtor, Lake Realty, Cornelius, NC.